Sourcing Opportunities in China: A Strategic Insight for Global Procurement

Published by: International Product Solutions (IPS)

Website: www.customproduct.com

Executive Summary

China has established itself as the world’s largest manufacturing hub, offering unparalleled production capacity, diverse industrial clusters, and a highly developed supply chain ecosystem. With expertise in electronics, automotive, textiles, and heavy machinery, China remains a preferred destination for businesses seeking cost-effective and scalable sourcing solutions. The country’s continued investment in automation, green energy, and digital transformation further strengthens its position as a global leader in manufacturing.

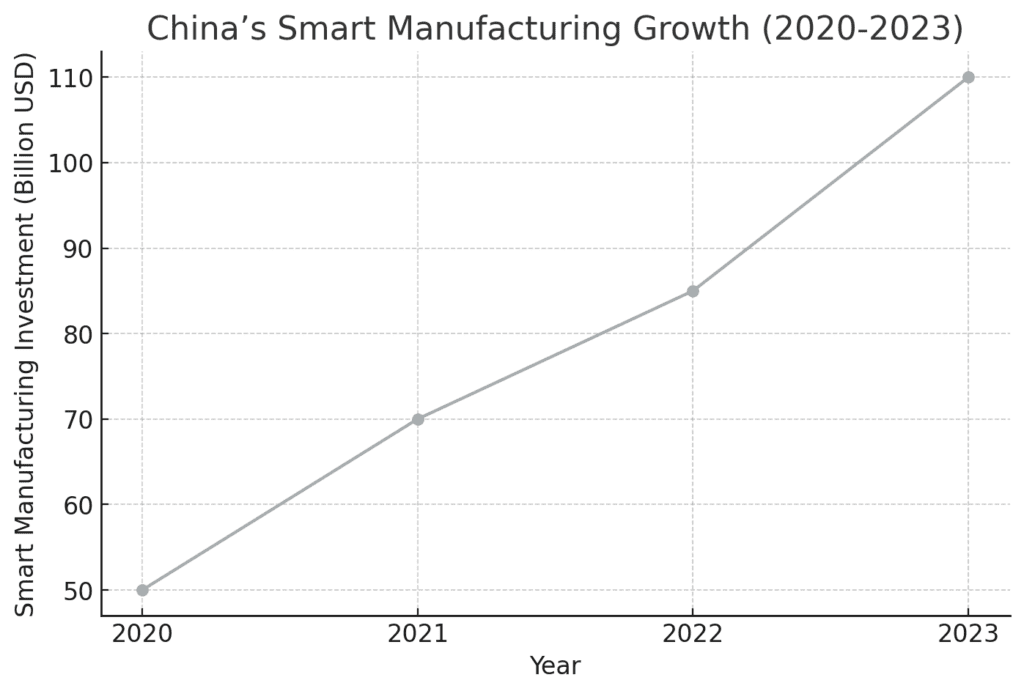

China’s industrial policy is focused on “Made in China 2025,” an initiative that aims to upgrade the country’s manufacturing capabilities to high-tech and value-added industries. Additionally, China’s Belt and Road Initiative (BRI) has expanded trade routes, improving logistics and infrastructure for seamless global supply chain integration. The increasing adoption of smart manufacturing and Industry 4.0 solutions, including AI-driven production, IoT-enabled logistics, and automation, makes China a compelling destination for businesses looking for innovation-driven sourcing solutions.

China’s Macroeconomic Overview

Population: ~1.4 billion (2023 estimate)

GDP Growth: ~5.0% annually, with sustained industrial expansion.

Major Cities: Beijing (capital), Shanghai, Guangzhou, Shenzhen, Chengdu, Chongqing, Wuhan

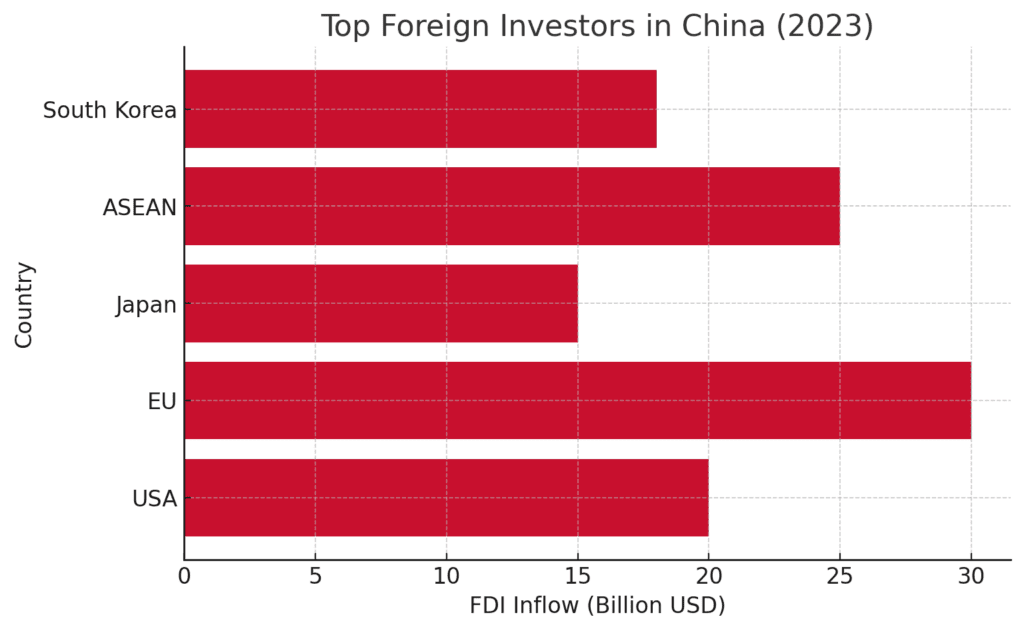

Trade Agreements: Regional Comprehensive Economic Partnership (RCEP), Belt and Road Initiative (BRI), Free Trade Agreements with multiple global markets, ASEAN-China Free Trade Area

Key Export Markets: USA, EU, Japan, ASEAN, South Korea, Latin America

Manufacturing Sector Contribution: 28% of global manufacturing output, with strong emphasis on high-tech industries, smart automation, and sustainable production.

China’s vast infrastructure, logistics network, and extensive industrial parks make it an efficient sourcing destination. The government’s focus on technological advancement, smart manufacturing, and sustainability further enhances its appeal for global companies. Additionally, China’s growing consumer base and middle-class expansion have made it an attractive domestic market for companies looking to establish a presence beyond sourcing.

Key Sectors for Sourcing in China

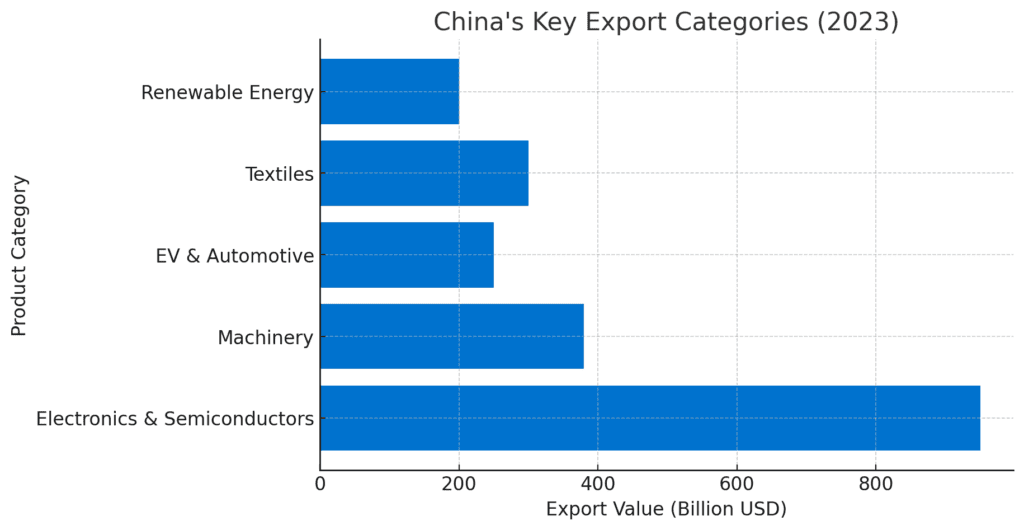

> Electronics & Semiconductors

Export Value (2023): ~$950 billion

Top Markets: USA, EU, ASEAN, Japan, South Korea

Advantages: World leader in consumer electronics, IoT devices, and semiconductor assembly. Strong ecosystem for R&D, innovation, and chip fabrication, with leading players such as SMIC and HiSilicon.

Challenges: Geopolitical trade restrictions, supply chain dependencies, and increasing IP protection concerns.

> Automotive & Electric Vehicles (EVs)

Export Value (2023): ~$250 billion

Top Markets: USA, Germany, UK, Southeast Asia, Latin America

Advantages: Rapidly growing EV production, strong battery supply chain, and major automakers expanding global reach. China dominates lithium-ion battery production and is home to companies like BYD and CATL.

Challenges: Dependence on foreign semiconductor chips, fluctuating raw material prices, and evolving international regulations on EV adoption.

> Machinery & Heavy Equipment

Export Value (2023): ~$380 billion

Top Markets: USA, Germany, India, Latin America, Middle East

Advantages: Competitive pricing, high precision manufacturing, and growing industrial automation. China leads in smart robotics, CNC machinery, and construction equipment.

Challenges: High logistics costs for heavy machinery, compliance with foreign safety standards, and competition from Germany and Japan in high-precision industries.

> Textiles & Apparel

Export Value (2023): ~$300 billion

Top Markets: USA, EU, Japan, South Korea, Middle East

Advantages: Large-scale production capacity, diverse material options, cost-effective labor, and sustainability innovations in eco-friendly textiles.

Challenges: Increasing labor costs, environmental concerns over textile production processes, and regulatory changes in key export markets.

> Renewable Energy & Green Technology

Export Value (2023): ~$200 billion

Top Markets: USA, EU, India, Latin America, Africa

Advantages: World leader in solar panels, wind turbines, and battery storage technology. Strong government policies supporting green energy, with large investments in hydrogen fuel and alternative energy sources.

Challenges: International trade restrictions on solar products, dependency on rare earth materials, and fluctuations in raw material costs.

Why Source from China?

Economies of Scale: Largest global manufacturing hub, with optimized supply chain efficiencies and cost-effective mass production.

Advanced Industrial Ecosystem: Well-established supplier networks across multiple sectors, allowing for streamlined production processes.

Innovation & R&D Leadership: Strong government investment in high-tech industries, AI, automation, and smart factories.

Diverse Supplier Base: Manufacturers ranging from low-cost mass production to high-precision engineering firms, accommodating different quality and cost requirements.

Government Incentives: Special economic zones (SEZs) and policies promoting foreign investment, including tax benefits and manufacturing subsidies.

Well-Connected Logistics: Extensive seaport, rail, and highway infrastructure supporting global exports, including high-speed freight services.

Growing Domestic Market: China’s expanding middle-class population presents opportunities for companies to both source and sell within the country.

Challenges & Considerations

Geopolitical Risks: Trade tensions may impact tariffs, export restrictions, and supply chain security, requiring businesses to diversify sourcing strategies.

IP Protection & Compliance: Businesses must take proactive measures to protect proprietary technology, including working with verified manufacturers and securing patents.

Labor & Regulatory Compliance: Environmental and labor regulations are evolving, requiring businesses to stay updated and ensure ethical sourcing practices.

Supply Chain Bottlenecks: Production delays may arise due to raw material shortages, logistics disruptions, and geopolitical influences.

Market Competition: China’s highly competitive landscape necessitates careful supplier selection, due diligence, and strategic negotiation.

Currency Exchange Risks: Fluctuations in exchange rates can impact pricing strategies and profitability for foreign companies sourcing from China.

IPS – Your Trusted Sourcing Partner

At International Product Solutions (IPS), we specialize in identifying reliable, high-quality factories in China to help businesses optimize their sourcing strategies. Our expertise in supplier verification, quality control, and logistics management ensures a seamless and cost-efficient procurement process. We provide end-to-end support, from supplier identification to ongoing compliance monitoring, ensuring your supply chain remains resilient and agile.

With decades of experience in global sourcing, IPS provides tailored solutions to help businesses navigate the complexities of international trade and manufacturing. Our local presence in China allows us to foster strong supplier relationships, conduct thorough factory audits, and mitigate sourcing risks effectively. Additionally, IPS offers comprehensive compliance support to ensure that all regulatory requirements are met, minimizing risk and maximizing operational efficiency.

For customized sourcing solutions and expert guidance, visit www.customproduct.com.

Copyright © 2024 International Product Solutions (IPS). All Rights Reserved.

https://www.worldbank.org/en/businessready

https://www.weforum.org/publications/the-global-competitiveness-report-2020/

OECD (2023), OECD Quarterly International Trade Statistics, Volume 2022 Issue 4, OECD Publishing, Paris, https://doi.org/10.1787/5a1ef126-en.